>アジア太平洋地域のモビリティ・アズ・ア・サービス市場、サービスタイプ別(カーシェアリング、バスシェアリング、電車、ライドヘイリング、自転車シェアリング、自動運転車など)、ソリューション別(ナビゲーションソリューション、チケットソリューション、テクノロジープラットフォーム、保険サービス、通信接続プロバイダーおよび決済エンジン)、交通機関タイプ別(公共および民間)、車両タイプ別(四輪車、バス、電車、マイクロモビリティ)、アプリケーションプラットフォーム別(IOS、Androidなど)、要件タイプ別(ファーストマイルおよびラストマイル接続、オフピークおよびシフト勤務通勤、毎日の通勤、空港または公共交通機関の駅への移動、都市間移動など)、組織規模別(大企業および中小企業(SMES))、用途別(商用および個人)、国別(中国、インド、韓国、オーストラリア、日本、シンガポール、マレーシア、タイ、インドネシア、フィリピン、その他のアジア太平洋地域)業界動向および2028年までの予測

市場分析と洞察: アジア太平洋地域のモビリティ・アズ・ア・サービス市場

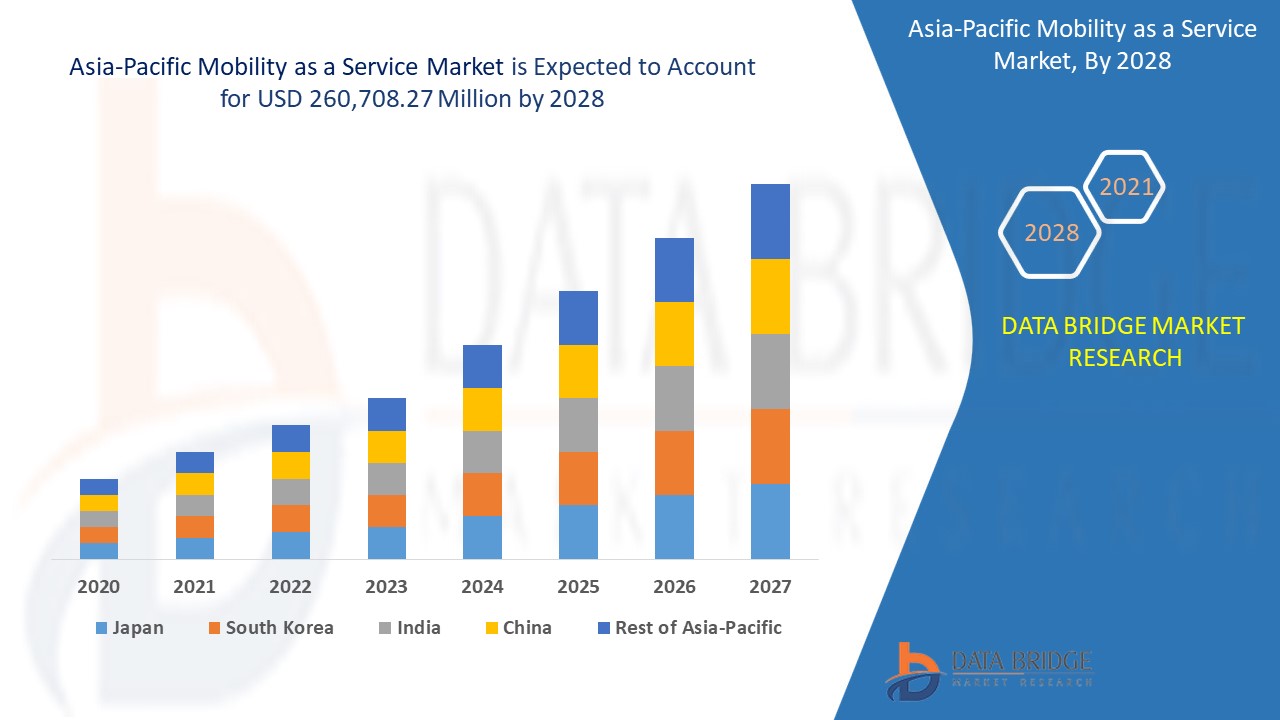

アジア太平洋地域のモビリティ・アズ・ア・サービス市場は、2021年から2028年の予測期間に市場が成長すると予想されています。データブリッジ・マーケット・リサーチは、市場は2021年から2028年の予測期間に33.7%のCAGRで成長し、2028年までに260,708.27百万米ドルに達すると分析しています。人口増加と都市化、そしてCO2排出量と交通渋滞の削減の必要性が市場の成長を牽引しています。

モビリティ アズ ア サービスとは、人々に交通手段を提供する消費者中心のモデルです。モビリティ アズ ア サービスは MaaS とも呼ばれ、交通手段 アズ ア サービス (TaaS) と呼ばれることもあります。モビリティ アズ ア サービスは、自動車や自転車のシェア、タクシー、レンタカー/リースなどの交通手段をデジタル チャネルを通じて統合し、消費者が複数の種類のモビリティ サービスを計画、予約、支払いできるようにするものです。MaaS 開発の主なコンセプトは、旅行者の旅行ニーズに基づいてモビリティ ソリューションを提供することです。

都市化の進展とスマート シティの取り組みにより、接続性とパフォーマンスが強化された高度な製品に対する需要が高まり、モビリティ サービス市場の成長が促進されています。市場プレーヤーは、製品を販売する各国の規制基準を満たす必要があり、これがモビリティ サービス市場の成長を制限しています。快適でクリーンな輸送手段を低コストで提供する電気自動車の成長は、モビリティ サービス市場にチャンスを生み出しています。自家用車とサービスの所有の生涯コストに対する認識の低さは、モビリティ サービス市場にとって大きな課題となるでしょう。

This mobility as a service market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographical expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Mobility as a Service Market Scope and Market Size

The mobility as a service market is segmented on the basis of service type, solution, transportation type, vehicle type, application platform, requirement type, organization size and usage. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of service type, the mobility as a service market is segmented into car sharing, bus sharing, train, ride hailing, bi-cycle sharing, self-driving cars and others. In 2021, ride hailing segment held larger share in the mobility as a service market due to the growing option for booking and comfort which has raise the demand for rail hailing services.

- On the basis of solution, the mobility as a service market is segmented into navigation solutions, ticketing solutions, technology platforms, insurance services, telecom connectivity providers and payment engines. In 2021, navigation solutions category has accounted for maximum market size due to growing importance of passenger safety and growing concern for minimizing travelling time has increase the demand for navigation solutions.

- On the basis of transportation type, the mobility as a service market is segmented into public and private. In 2021, public category has accounted for maximum market size due to rising vehicle traffic which has increase the demand for mobility services.

- On the basis of vehicle type, the mobility as a service market is segmented into four wheelers, bus, train and micro mobility. In 2021, four wheelers segment held the largest share in the market which is mainly attributed to rising investment in the transportation infrastructure which has fuel the demand for mobility services.

- On the basis of application platform, the mobility as a service market is segmented into IOS, android and others. In 2021, android category has accounted for maximum market size owing to rising internet penetration and growing usage of mobile in the developing economies which has resulted in increasing demand for mobility services for the android application.

- 要件タイプに基づいて、モビリティ・アズ・ア・サービス市場は、ファーストマイルとラストマイルの接続性、オフピークおよびシフト勤務の通勤、毎日の通勤、空港または公共交通機関の駅への旅行、都市間旅行などに分割されています。2021年には、都市間旅行のカテゴリーが、モビリティサービスの需要を高めた車両交通量の増加により、より大きな市場シェアを占めました。

- 組織規模に基づいて、モビリティ・アズ・ア・サービス市場は、大企業と中小企業(SMES)に分類されます。2021年には、輸送業界で存在感を高めているカーシェアリングや輸送インフラへのさまざまなテクノロジー大手からの投資が増加したため、大企業セグメントがより大きな市場シェアを占めました。

- 使用方法に基づいて、モビリティ・アズ・ア・サービス市場は商業用と個人用に分割されます。2021年には、商品や資材の安全で効果的かつコストに優しい輸送オプションのニーズが高まったため、商業用カテゴリがより大きな市場シェアを占めました。

モビリティ・アズ・ア・サービス市場の国別分析

モビリティ・アズ・ア・サービス市場が分析され、市場規模の情報が、上記の国、サービスタイプ、ソリューション、輸送タイプ、車両タイプ、アプリケーションプラットフォーム、要件タイプ、組織規模、および使用法別に提供されます。

世界のモビリティ・アズ・ア・サービス市場レポートで取り上げられている国は、中国、インド、日本、韓国、オーストラリア、シンガポール、タイ、インドネシア、マレーシア、フィリピン、およびその他のアジア太平洋諸国です。

アジア太平洋地域のモビリティ・アズ・ア・サービス市場は中国が主導権を握っており、開発途上国における人口増加と都市化により、予測期間中に最も高いCAGRで成長すると予想されています。これらの国では、これらの国でのMaaS市場の成長に寄与する日本とインドがこれに続きます。また、地域全体での自動車排出量削減と交通渋滞の出現も、アジア太平洋地域のモビリティ・アズ・ア・サービス市場を後押ししています。

モビリティ・アズ・ア・サービス市場レポートの国別セクションでは、市場の現在および将来の動向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、アジア太平洋ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響も考慮されます。

OEM(相手先ブランド供給業者)の増加

モビリティ・アズ・ア・サービス市場は、モビリティ・アズ・ア・サービス市場向けのさまざまな種類の製品のインストールベースの各国での成長、ライフライン曲線を使用したテクノロジーの影響、規制シナリオの変更、およびそれらがモビリティ・アズ・ア・サービス市場に与える影響に関する詳細な市場分析も提供します。データは、2010年から2018年までの履歴期間で利用できます。

競争環境とモビリティ・アズ・ア・サービス市場シェア分析

モビリティ・アズ・ア・サービス市場の競争状況は、競合他社ごとに詳細を提供します。含まれる詳細には、企業概要、企業財務、収益、市場潜在性、研究開発への投資、新規市場への取り組み、アジア太平洋地域でのプレゼンス、生産拠点と施設、企業の強みと弱み、製品発売、臨床試験パイプライン、ブランド分析、製品承認、特許、製品の幅と広さ、アプリケーションの優位性、技術ライフライン曲線などがあります。提供されている上記のデータ ポイントは、アジア太平洋地域のモビリティ・アズ・ア・サービス市場に関連する企業の重点にのみ関連しています。

モビリティ・アズ・ア・サービス市場レポートで取り上げられている主要企業には、Moovit Inc. (Intel Corporation の子会社)、UbiGo Innovation AB、MaaS Global Oy、SkedGo Pty Ltd、Beijing Xiaoju Technology Co, Ltd.、Uber Technologies, Inc.、EasyMile、Ridecell, Inc.、Bolt Technology OÜ、Citymapper Limited、Cubic Corporation、innovation in traffic systems SE、BRIDJ Pty Ltd、ANI Technologies Pvt. Ltd.、Splyt Technologies Ltd.、BlaBlaCar などがあります。DBMR のアナリストは、競争上の強みを理解し、各競合他社の競合分析を個別に提供します。

例えば、

- 2020年11月、北京小居科技有限公司は、配車サービス向けに特注された初の電気自動車「D1」を発売した。このD1は中国の主要都市向けに開発されたもので、自動運転とAI技術の開発である。この製品の発売により、同社はシェアモビリティを通じてより良い移動体験を提供することができる。

- 2020年11月、Uber Technologies, Inc.は、ファーストマイルとラストマイルの接続性を実現するE-リキシャを発売しました。これらのE-リキシャは、インドのデリーメトロのブルーラインの26駅で利用できます。この製品は、乗客に優れた接続性を実現するモビリティソリューションを提供します。これにより、同社は市場での製品ポートフォリオを強化することができます。

製品の発売、買収、その他の戦略により、カバレッジとプレゼンスが拡大し、企業の市場シェアが高まります。また、企業の製品ポートフォリオを通じて、サービスとしてのモビリティの提供を改善できるというメリットも組織にもたらされます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC MOBILITY AS A SERVICE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MARKET APPLICATION PLATFORM COVERAGE GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MULTIVARIATE MODELING

2.1 SERVICE TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 TECHNOLOGY TRENDS FOR MAAS PLATFORM (NFC/RFID)

6 SUPPLY CHAIN

6.1 PLATFORM PROVIDERS

6.2 TRANSPORTATION SYSTEM

6.3 PRODUCT AND SERVICE

6.4 GOVERNMENT LAWS

6.5 CUSTOMER

7 BUSINESS MODEL

7.1 BUSINESS TO BUSINESS

7.2 BUSINESS TO INDUSTRY

7.3 BUSINESS TO GOVERNMENT

7.4 BUSINESS TO CUSTOMER

8 TYPES OF PAYMENT SOLUTIONS FOR TRANSIT

8.1 CASHLESS PAYMENT

8.2 MOBILE PAYMENT

8.3 PREPAID SOLUTIONS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 INCREASING SMART CITY PROJECT IMPLEMENTATION AND RISING URBANIZATION

9.1.2 RISING INTERNET PENETRATION AND MOBILE DEVICES

9.1.3 GROWTH IN NUMBER OF ORIGINAL EQUIPMENT MANUFACTURERS (OEMS)

9.1.4 RISING DEMAND FOR ONE STOP SOLUTIONS AMONG THE CONSUMERS

9.1.5 STRINGENT GOVERNMENT REGULATIONS REGARDING EMISSION CONTROL

9.2 RESTRAINTS

9.2.1 VARYING REGULATION OF INTERNATIONAL MARKET

9.2.2 TRAFFIC CONGESTION WITH GROWING INFRASTRUCTURE

9.2.3 LACK OF AWARENESS IN THE DEVELOPED ECONOMIES

9.3 OPPORTUNITIES

9.3.1 INCREASING USAGE OF AUTONOMOUS CARS

9.3.2 RISE IN ONLINE PAYMENT METHOD FOR USERS

9.3.3 GROWTH OF ELECTRIC VEHICLES FOR COMFORTABLE AND CLEAN TRANSPORT AT A LOWER COST

9.3.4 COMBINING BIG DATA WITH NEW AUTONOMOUS TRANSPORT SYSTEMS

9.4 CHALLENGES

9.4.1 LOW AWARENESS REGARDING THE LIFETIME COST OF PRIVATE VEHICLE AND SERVICE OWNERSHIPS

9.4.2 CONNECTIVITY ISSUES IN DEVELOPING COUNTRIES

10 COVID-19 IMPACT ON ASIA-PACIFIC MOBILITY AS A SERVICE MARKET

10.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

10.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

10.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

10.4 PRICE IMPACT

10.5 IMPACT ON DEMAND AND SUPPLY CHAIN

10.6 CONCLUSION

11 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET, BY SERVICE

11.1 OVERVIEW

11.2 RIDE HAILING

11.3 CAR SHARING

11.4 BUS SHARING

11.5 BI-CYCLE SHARING

11.6 SELF-DRIVING CARS

11.7 TRAIN

11.8 OTHERS

12 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET, BY SOLUTIONS

12.1 OVERVIEW

12.2 NAVIGATION SOLUTIONS

12.3 PAYMENT ENGINES

12.4 INSURANCE SERVICES

12.5 TICKETING SOLUTIONS

12.6 TECHNOLOGY PLATFORMS

12.7 TELECOM CONNECTIVITY PROVIDER

13 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET, BY TRANSPORTATION TYPE

13.1 OVERVIEW

13.2 PUBLIC

13.3 PRIVATE

14 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET, BY VEHICLE TYPE

14.1 OVERVIEW

14.2 FOUR WHEELER

14.3 BUS

14.4 TRAIN

14.5 MICRO MOBILITY

15 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET, BY REQUIREMENT TYPE

15.1 OVERVIEW

15.2 INTER CITY TRIPS

15.3 AIRPORT OR MASS TRANSIT STATIONS TRIPS

15.4 FIRST & LAST MILE CONNECTIVITY

15.5 OFF-PEAK & SHIFT WORK COMMUTE

15.6 DAILY COMMUTER

15.7 OTHERS

16 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET, BY ORGANIZATION SIZE

16.1 OVERVIEW

16.2 LARGE ORGANIZATION

16.3 SMALL & MEDIUM ORGANIZATION

17 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET, BY USAGE

17.1 OVERVIEW

17.2 COMMERCIAL

17.3 PERSONAL

18 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET, BY APPLICATION

18.1 OVERVIEW

18.2 ANDORID

18.3 IOS

18.4 OTHERS

19 ASIA-PACIFIC MOBILITY AS A SERVICE (MAAS) MARKET, BY GEOGRAPHY

19.1 ASIA-PACIFIC

19.1.1 CHINA

19.1.2 JAPAN

19.1.3 INDIA

19.1.4 SOUTH KOREA

19.1.5 AUSTRALIA

19.1.6 SINGAPORE

19.1.7 INDONESIA

19.1.8 THAILAND

19.1.9 MALAYSIA

19.1.10 PHILIPPINES

19.1.11 REST OF ASIA-PACIFIC

20 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

21 SWOT

22 COMPANY PROFILES

22.1 BEIJING XIAOJU TECHNOLOGY CO, LTD.

22.1.1 COMPANY SNAPSHOT

22.1.2 SERVICE PORTFOLIO

22.1.3 RECENT DEVELOPMENTS

22.2 UBER TECHNOLOGIES, INC.

22.2.1 COMPANY SNAPSHOT

22.2.2 REVENUE ANALYSIS

22.2.3 COMPANY SHARE ANALYSIS

22.2.4 PRODUCT PORTFOLIO

22.2.5 RECENT DEVELOPMENTS

22.3 LYFT, INC.

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 COMPANY SHARE ANALYSIS

22.3.4 PRODUCT PORTFOLIO

22.3.5 RECENT DEVELOPMENTS

22.4 ANI TECHNOLOGIES PVT. LTD.

22.4.1 COMPANY SNAPSHOT

22.4.2 COMPANY SHARE ANALYSIS

22.4.3 SERVICE PORTFOLIO

22.4.4 RECENT DEVELOPMENTS

22.5 BLABLACAR

22.5.1 COMPANY SNAPSHOT

22.5.2 PRODUCT PORTFOLIO

22.5.3 RECENT DEVELOPMENTS

22.6 BOLT TECHNOLOGY OÜ

22.6.1 COMPANY SNAPSHOT

22.6.2 COMPANY SHARE ANALYSIS

22.6.3 PRODUCT PORTFOLIO

22.6.4 RECENT DEVELOPMENT

22.7 BRIDJ PTY LTD

22.7.1 COMPANY SNAPSHOT

22.7.2 SOLUTION PORTFOLIO

22.7.3 RECENT DEVELOPMENT

22.8 CITYMAPPER LIMITED

22.8.1 COMPANY SNAPSHOT

22.8.2 SOLUTION PORTFOLIO

22.8.3 RECENT DEVELOPMENT

22.9 COMMUNAUTO

22.9.1 COMPANY SNAPSHOT

22.9.2 SERVICE PORTFOLIO

22.9.3 RECENT DEVELOPMENTS

22.1 CUBIC CORPORATION

22.10.1 COMPANY SNAPSHOT

22.10.2 REVENUE ANALYSIS

22.10.3 COMPANY SHARE ANALYSIS

22.10.4 SOLUTION PORTFOLIO

22.10.5 RECENT DEVELOPMENTS

22.11 CURB MOBILITY

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENTS

22.12 EASYMILE

22.12.1 COMPANY SNAPSHOT

22.12.2 SOLUTION PORTFOLIO

22.12.3 RECENT DEVELOPMENT

22.13 GETT

22.13.1 COMPANY SNAPSHOT

22.13.2 COMPANY SHARE ANALYSIS

22.13.3 PRODUCT PORTFOLIO

22.13.4 RECENT DEVELOPMENTS

22.14 GREENLINES TECHNOLOGY INC.

22.14.1 COMPANY SNAPSHOT

22.14.2 PRODUCT PORTFOLIO

22.14.3 RECENT DEVELOPMENT

22.15 INNOVATION IN TRAFFIC SYSTEMS SE

22.15.1 COMPANY SNAPSHOT

22.15.2 REVENUE ANALYSIS

22.15.3 SOLUTION PORTFOLIO

22.15.4 RECENT DEVELOPMENT

22.16 MAAS ASIA-PACIFIC OY

22.16.1 COMPANY SNAPSHOT

22.16.2 SERVICE PORTFOLIO

22.16.3 RECENT DEVELOPMENTS

22.17 MAXI MOBILITY S.L.

22.17.1 COMPANY SNAPSHOT

22.17.2 PRODUCT PORTFOLIO

22.17.3 RECENT DEVELOPMENTS

22.18 MOBILLEO

22.18.1 COMPANY SNAPSHOT

22.18.2 SOLUTION PORTFOLIO

22.18.3 RECENT DEVELOPMENT

22.19 MOOVEL GROUP GMBH (A SUBSIDIARY OF DAIMLER AG)

22.19.1 COMPANY SNAPSHOT

22.19.2 REVENUE ANALYSIS

22.19.3 PRODUCT PORTFOLIO

22.19.4 RECENT DEVELOPMENTS

22.2 MOOVIT INC. (A SUBSIDIARY OF INTEL CORPORATION)

22.20.1 COMPANY SNAPSHOT

22.20.2 REVENUE ANALYSIS

22.20.3 SOLUTION PORTFOLIO

22.20.4 RECENT DEVELOPMENTS

22.21 MOTIONTAG GMBH

22.21.1 COMPANY SNAPSHOT

22.21.2 SOLUTION PORTFOLIO

22.21.3 RECENT DEVELOPMENTS

22.22 RIDECELL, INC

22.22.1 COMPANY SNAPSHOT

22.22.2 SOLUTION PORTFOLIO

22.22.3 RECENT DEVELOPMENTS

22.23 SKEDGO PTY LTD

22.23.1 COMPANY SNAPSHOT

22.23.2 TECHNOLOGY PORTFOLIO

22.23.3 RECENT DEVELOPMENT

22.24 SPLYT TECHNOLOGIES LTD.

22.24.1 COMPANY SNAPSHOT

22.24.2 PRODUCT PORTFOLIO

22.24.3 RECENT DEVELOPMENTS

22.25 UBIGO INNOVATION AB

22.25.1 COMPANY SNAPSHOT

22.25.2 SERVICE PORTFOLIO

22.25.3 RECENT DEVELOPMENTS

22.26 VELOCIA

22.26.1 COMPANY SNAPSHOT

22.26.2 PRODUCT PORTFOLIO

22.26.3 RECENT DEVELOPMENT

22.27 ZOOX, INC. (A SUBSIDIARY OF AMAZON.COM, INC.)

22.27.1 COMPANY SNAPSHOT

22.27.2 REVENUE ANALYSIS

22.27.3 PRODUCT PORTFOLIO

22.27.4 RECENT DEVELOPMENT

23 QUESTIONNAIRE

24 RELATED REPORTS

表のリスト

LIST OF TABLES

TABLE 1 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 2 ASIA-PACIFIC RIDE HAILING IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 3 ASIA-PACIFIC CAR SHARING IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 4 ASIA-PACIFIC BUS SHARING IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 5 ASIA-PACIFIC BI-CYCLE SHARING IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 6 ASIA-PACIFIC SELF-DRIVING CARS IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 7 ASIA-PACIFIC TRAIN IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 8 ASIA-PACIFIC OTHERS IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 9 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET, BY SOLUTIONS, 2019-2028 (USD MILLION)

TABLE 10 ASIA-PACIFIC NAVIGATION SOLUTIONS IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 11 ASIA-PACIFIC PAYMENT ENGINES IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 12 ASIA-PACIFIC INSURANCE SERVICES IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 13 ASIA-PACIFIC TICKETING SOLUTIONS IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 14 ASIA-PACIFIC TECHNOLOGY PLATFORMS IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 15 ASIA-PACIFIC TELECOM CONNECTIVITY PROVIDER IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 16 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET, BY TRANSPORTATION TYPE, 2019-2028 (USD MILLION)

TABLE 17 ASIA-PACIFIC PUBLIC IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 18 ASIA-PACIFIC PRIVATE IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 19 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET, BY VEHICLE TYPE, 2019-2028 (USD MILLION)

TABLE 20 ASIA-PACIFIC FOUR WHEELER IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 21 ASIA-PACIFIC BUS IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 22 ASIA-PACIFIC TRAIN IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 23 ASIA-PACIFIC MICRO MOBILITY IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 24 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET, BY REQUIREMENT TYPE, 2019-2028 (USD MILLION)

TABLE 25 ASIA-PACIFIC INTER CITY TRIPS IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 26 ASIA-PACIFIC AIRPORT OR MASS TRANSIT STATIONS TRIPS IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 27 ASIA-PACIFIC FIRST & LAST MILE CONNECTIVITY IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 28 ASIA-PACIFIC OFF-PEAK & SHIFT WORK COMMUTE IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 29 ASIA-PACIFIC DAILY COMMUTER IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 30 ASIA-PACIFIC OTHERS IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 31 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 32 ASIA-PACIFIC LARGE ORGANIZATION IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 33 ASIA-PACIFIC SMALL & MEDIUM ORGANIZATION IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 34 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET, BY USAGE, 2019-2028 (USD MILLION)

TABLE 35 ASIA-PACIFIC COMMERCIAL IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 36 ASIA-PACIFIC PERSONAL IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 37 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 38 ASIA-PACIFIC ANDROID IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 39 ASIA-PACIFIC IOS IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 40 ASIA-PACIFIC OTHERS IN MOBILITY AS A SERVICE MARKET, BY REGION,2019-2028, (USD MILLION)

TABLE 41 ASIA-PACIFIC MOBILITY AS A SERVICE (MAAS) MARKET,BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 42 ASIA-PACIFIC MOBILITY AS A SERVICE (MAAS) MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 43 ASIA-PACIFIC MOBILITY AS A SERVICE (MAAS) MARKET, BY SOLUTIONS, 2019-2028 (USD MILLION)

TABLE 44 ASIA-PACIFIC MOBILITY AS A SERVICE (MAAS) MARKET, BY TRANSPORTATION TYPE, 2019-2028 (USD MILLION)

TABLE 45 ASIA-PACIFIC MOBILITY AS A SERVICE (MAAS) MARKET, BY VEHICLE TYPE, 2019-2028 (USD MILLION)

TABLE 46 ASIA-PACIFIC MOBILITY AS A SERVICE (MAAS)S MARKET, BY REQUIREMENT TYPE, 2019-2028 (USD MILLION)

TABLE 47 ASIA-PACIFIC MOBILITY AS A SERVICE (MAAS) MARKET, BY ORGANISATION SIZE, 2019-2028 (USD MILLION)

TABLE 48 ASIA-PACIFIC MOBILITY AS A SERVICE (MAAS) MARKET, BY USAGE, 2019-2028 (USD MILLION)

TABLE 49 ASIA-PACIFIC MOBILITY AS A SERVICE (MAAS) MARKET, BY APPLICATION , 2019-2028 (USD MILLION)

TABLE 50 CHINA MOBILITY AS A SERVICE (MAAS) MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 51 CHINA MOBILITY AS A SERVICE (MAAS) MARKET, BY SOLUTIONS, 2019-2028 (USD MILLION)

TABLE 52 CHINA MOBILITY AS A SERVICE (MAAS) MARKET, BY TRANSPORTATION TYPE, 2019-2028 (USD MILLION)

TABLE 53 CHINA MOBILITY AS A SERVICE (MAAS) MARKET, BY VEHICLE TYPE, 2019-2028 (USD MILLION)

TABLE 54 CHINA MOBILITY AS A SERVICE (MAAS)S MARKET, BY REQUIREMENT TYPE, 2019-2028 (USD MILLION)

TABLE 55 CHINA MOBILITY AS A SERVICE (MAAS) MARKET, BY ORGANISATION SIZE, 2019-2028 (USD MILLION)

TABLE 56 CHINA MOBILITY AS A SERVICE (MAAS) MARKET, BY USAGE, 2019-2028 (USD MILLION)

TABLE 57 CHINA MOBILITY AS A SERVICE (MAAS) MARKET, BY APPLICATION , 2019-2028 (USD MILLION)

TABLE 58 JAPAN MOBILITY AS A SERVICE (MAAS) MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 59 JAPAN MOBILITY AS A SERVICE (MAAS) MARKET, BY SOLUTIONS, 2019-2028 (USD MILLION)

TABLE 60 JAPAN MOBILITY AS A SERVICE (MAAS) MARKET, BY TRANSPORTATION TYPE, 2019-2028 (USD MILLION)

TABLE 61 JAPAN MOBILITY AS A SERVICE (MAAS) MARKET, BY VEHICLE TYPE, 2019-2028 (USD MILLION)

TABLE 62 JAPAN MOBILITY AS A SERVICE (MAAS)S MARKET, BY REQUIREMENT TYPE, 2019-2028 (USD MILLION)

TABLE 63 JAPAN MOBILITY AS A SERVICE (MAAS) MARKET, BY ORGANISATION SIZE, 2019-2028 (USD MILLION)

TABLE 64 JAPAN MOBILITY AS A SERVICE (MAAS) MARKET, BY USAGE, 2019-2028 (USD MILLION)

TABLE 65 JAPAN MOBILITY AS A SERVICE (MAAS) MARKET, BY APPLICATION , 2019-2028 (USD MILLION)

TABLE 66 INDIA MOBILITY AS A SERVICE (MAAS) MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 67 INDIA MOBILITY AS A SERVICE (MAAS) MARKET, BY SOLUTIONS, 2019-2028 (USD MILLION)

TABLE 68 INDIA MOBILITY AS A SERVICE (MAAS) MARKET, BY TRANSPORTATION TYPE, 2019-2028 (USD MILLION)

TABLE 69 INDIA MOBILITY AS A SERVICE (MAAS) MARKET, BY VEHICLE TYPE, 2019-2028 (USD MILLION)

TABLE 70 INDIA MOBILITY AS A SERVICE (MAAS)S MARKET, BY REQUIREMENT TYPE, 2019-2028 (USD MILLION)

TABLE 71 INDIA MOBILITY AS A SERVICE (MAAS) MARKET, BY ORGANISATION SIZE, 2019-2028 (USD MILLION)

TABLE 72 INDIA MOBILITY AS A SERVICE (MAAS) MARKET, BY USAGE, 2019-2028 (USD MILLION)

TABLE 73 INDIA MOBILITY AS A SERVICE (MAAS) MARKET, BY APPLICATION , 2019-2028 (USD MILLION)

TABLE 74 SOUTH KOREA MOBILITY AS A SERVICE (MAAS) MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 75 SOUTH KOREA MOBILITY AS A SERVICE (MAAS) MARKET, BY SOLUTIONS, 2019-2028 (USD MILLION)

TABLE 76 SOUTH KOREA MOBILITY AS A SERVICE (MAAS) MARKET, BY TRANSPORTATION TYPE, 2019-2028 (USD MILLION)

TABLE 77 SOUTH KOREA MOBILITY AS A SERVICE (MAAS) MARKET, BY VEHICLE TYPE, 2019-2028 (USD MILLION)

TABLE 78 SOUTH KOREA MOBILITY AS A SERVICE (MAAS)S MARKET, BY REQUIREMENT TYPE, 2019-2028 (USD MILLION)

TABLE 79 SOUTH KOREA MOBILITY AS A SERVICE (MAAS) MARKET, BY ORGANISATION SIZE, 2019-2028 (USD MILLION)

TABLE 80 SOUTH KOREA MOBILITY AS A SERVICE (MAAS) MARKET, BY USAGE, 2019-2028 (USD MILLION)

TABLE 81 SOUTH KOREA MOBILITY AS A SERVICE (MAAS) MARKET, BY APPLICATION , 2019-2028 (USD MILLION)

TABLE 82 AUSTRALIA MOBILITY AS A SERVICE (MAAS) MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 83 AUSTRALIA MOBILITY AS A SERVICE (MAAS) MARKET, BY SOLUTIONS, 2019-2028 (USD MILLION)

TABLE 84 AUSTRALIA MOBILITY AS A SERVICE (MAAS) MARKET, BY TRANSPORTATION TYPE, 2019-2028 (USD MILLION)

TABLE 85 AUSTRALIA MOBILITY AS A SERVICE (MAAS) MARKET, BY VEHICLE TYPE, 2019-2028 (USD MILLION)

TABLE 86 AUSTRALIA MOBILITY AS A SERVICE (MAAS)S MARKET, BY REQUIREMENT TYPE, 2019-2028 (USD MILLION)

TABLE 87 AUSTRALIA MOBILITY AS A SERVICE (MAAS) MARKET, BY ORGANISATION SIZE, 2019-2028 (USD MILLION)

TABLE 88 AUSTRALIA MOBILITY AS A SERVICE (MAAS) MARKET, BY USAGE, 2019-2028 (USD MILLION)

TABLE 89 AUSTRALIA MOBILITY AS A SERVICE (MAAS) MARKET, BY APPLICATION , 2019-2028 (USD MILLION)

TABLE 90 SINGAPORE MOBILITY AS A SERVICE (MAAS) MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 91 SINGAPORE MOBILITY AS A SERVICE (MAAS) MARKET, BY SOLUTIONS, 2019-2028 (USD MILLION)

TABLE 92 SINGAPORE MOBILITY AS A SERVICE (MAAS) MARKET, BY TRANSPORTATION TYPE, 2019-2028 (USD MILLION)

TABLE 93 SINGAPORE MOBILITY AS A SERVICE (MAAS) MARKET, BY VEHICLE TYPE, 2019-2028 (USD MILLION)

TABLE 94 SINGAPORE MOBILITY AS A SERVICE (MAAS)S MARKET, BY REQUIREMENT TYPE, 2019-2028 (USD MILLION)

TABLE 95 SINGAPORE MOBILITY AS A SERVICE (MAAS) MARKET, BY ORGANISATION SIZE, 2019-2028 (USD MILLION)

TABLE 96 SINGAPORE MOBILITY AS A SERVICE (MAAS) MARKET, BY USAGE, 2019-2028 (USD MILLION)

TABLE 97 SINGAPORE MOBILITY AS A SERVICE (MAAS) MARKET, BY APPLICATION , 2019-2028 (USD MILLION)

TABLE 98 INDONESIA MOBILITY AS A SERVICE (MAAS) MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 99 INDONESIA MOBILITY AS A SERVICE (MAAS) MARKET, BY SOLUTIONS, 2019-2028 (USD MILLION)

TABLE 100 INDONESIA MOBILITY AS A SERVICE (MAAS) MARKET, BY TRANSPORTATION TYPE, 2019-2028 (USD MILLION)

TABLE 101 INDONESIA MOBILITY AS A SERVICE (MAAS) MARKET, BY VEHICLE TYPE, 2019-2028 (USD MILLION)

TABLE 102 INDONESIA MOBILITY AS A SERVICE (MAAS)S MARKET, BY REQUIREMENT TYPE, 2019-2028 (USD MILLION)

TABLE 103 INDONESIA MOBILITY AS A SERVICE (MAAS) MARKET, BY ORGANISATION SIZE, 2019-2028 (USD MILLION)

TABLE 104 INDONESIA MOBILITY AS A SERVICE (MAAS) MARKET, BY USAGE, 2019-2028 (USD MILLION)

TABLE 105 INDONESIA MOBILITY AS A SERVICE (MAAS) MARKET, BY APPLICATION , 2019-2028 (USD MILLION)

TABLE 106 THAILAND MOBILITY AS A SERVICE (MAAS) MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 107 THAILAND MOBILITY AS A SERVICE (MAAS) MARKET, BY SOLUTIONS, 2019-2028 (USD MILLION)

TABLE 108 THAILAND MOBILITY AS A SERVICE (MAAS) MARKET, BY TRANSPORTATION TYPE, 2019-2028 (USD MILLION)

TABLE 109 THAILAND MOBILITY AS A SERVICE (MAAS) MARKET, BY VEHICLE TYPE, 2019-2028 (USD MILLION)

TABLE 110 THAILAND MOBILITY AS A SERVICE (MAAS)S MARKET, BY REQUIREMENT TYPE, 2019-2028 (USD MILLION)

TABLE 111 THAILAND MOBILITY AS A SERVICE (MAAS) MARKET, BY ORGANISATION SIZE, 2019-2028 (USD MILLION)

TABLE 112 THAILAND MOBILITY AS A SERVICE (MAAS) MARKET, BY USAGE, 2019-2028 (USD MILLION)

TABLE 113 THAILAND MOBILITY AS A SERVICE (MAAS) MARKET, BY APPLICATION , 2019-2028 (USD MILLION)

TABLE 114 MALAYSIA MOBILITY AS A SERVICE (MAAS) MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 115 MALAYSIA MOBILITY AS A SERVICE (MAAS) MARKET, BY SOLUTIONS, 2019-2028 (USD MILLION)

TABLE 116 MALAYSIA MOBILITY AS A SERVICE (MAAS) MARKET, BY TRANSPORTATION TYPE, 2019-2028 (USD MILLION)

TABLE 117 MALAYSIA MOBILITY AS A SERVICE (MAAS) MARKET, BY VEHICLE TYPE, 2019-2028 (USD MILLION)

TABLE 118 MALAYSIA MOBILITY AS A SERVICE (MAAS)S MARKET, BY REQUIREMENT TYPE, 2019-2028 (USD MILLION)

TABLE 119 MALAYSIA MOBILITY AS A SERVICE (MAAS) MARKET, BY ORGANISATION SIZE, 2019-2028 (USD MILLION)

TABLE 120 MALAYSIA MOBILITY AS A SERVICE (MAAS) MARKET, BY USAGE, 2019-2028 (USD MILLION)

TABLE 121 MALAYSIA MOBILITY AS A SERVICE (MAAS) MARKET, BY APPLICATION , 2019-2028 (USD MILLION)

TABLE 122 PHILIPPINES MOBILITY AS A SERVICE (MAAS) MARKET, BY SERVICE, 2019-2028 (USD MILLION)

TABLE 123 PHILIPPINES MOBILITY AS A SERVICE (MAAS) MARKET, BY SOLUTIONS, 2019-2028 (USD MILLION)

TABLE 124 PHILIPPINES MOBILITY AS A SERVICE (MAAS) MARKET, BY TRANSPORTATION TYPE, 2019-2028 (USD MILLION)

TABLE 125 PHILIPPINES MOBILITY AS A SERVICE (MAAS) MARKET, BY VEHICLE TYPE, 2019-2028 (USD MILLION)

TABLE 126 PHILIPPINES MOBILITY AS A SERVICE (MAAS)S MARKET, BY REQUIREMENT TYPE, 2019-2028 (USD MILLION)

TABLE 127 PHILIPPINES MOBILITY AS A SERVICE (MAAS) MARKET, BY ORGANISATION SIZE, 2019-2028 (USD MILLION)

TABLE 128 PHILIPPINES MOBILITY AS A SERVICE (MAAS) MARKET, BY USAGE, 2019-2028 (USD MILLION)

TABLE 129 PHILIPPINES MOBILITY AS A SERVICE (MAAS) MARKET, BY APPLICATION , 2019-2028 (USD MILLION)

TABLE 130 PHILIPPINES MOBILITY AS A SERVICE (MAAS) MARKET, BY SERVICE, 2019-2028 (USD MILLION)

図表一覧

LIST OF FIGURES

FIGURE 1 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: MARKET APPLICATION PLATFORM COVERAGE GRID

FIGURE 9 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: SEGMENTATION

FIGURE 11 INCREASING SMART CITY PROJECT IMPLEMENTATION AND RISING URBANIZATION IS EXPECTED TO DRIVE ASIA-PACIFIC MOBILITY AS A SERVICE MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 CAR SHARING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA-PACIFIC MOBILITY AS A SERVICE MARKET IN 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINT, OPPORTUNITIES AND CHALLENGE OF ASIA-PACIFIC MOBILITY AS A SERVICE MARKET

FIGURE 14 DEVELOPMENT INDEX OF SMART CITY SERVICE CATEGORIES

FIGURE 15 COST COMPARISON OF AUTONOMOUS VEHICLE USERS

FIGURE 16 TOP ONLINE METHOD WORLDWIDE, 2019

FIGURE 17 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: BY SERVICE, 2020

FIGURE 18 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: BY SOLUTIONS, 2020

FIGURE 19 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: BY TRANSPORTATION TYPE, 2020

FIGURE 20 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: BY VEHICLE TYPE, 2020

FIGURE 21 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: BY REQUIREMENT TYPE, 2020

FIGURE 22 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: BY ORGANIZATION SIZE, 2020

FIGURE 23 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: BY USAGE, 2020

FIGURE 24 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: BY APPLICATION, 2020

FIGURE 25 ASIA-PACIFIC MOBILITY AS A SERVICE (MAAS) MARKET: SNAPSHOT (2020)

FIGURE 26 ASIA-PACIFIC MOBILITY AS A SERVICE (MAAS) MARKET: BY COUNTRY(2020)

FIGURE 27 ASIA-PACIFIC MOBILITY AS A SERVICE (MAAS) MARKET: BY COUNTRY (2019-2028)

FIGURE 28 ASIA-PACIFIC MOBILITY AS A SERVICE (MAAS) MARKET: BY COUNTRY (2019-2028)

FIGURE 29 ASIA-PACIFIC MOBILITY AS A SERVICE (MAAS) MARKET: BY SERVICES (2021-2028)

FIGURE 30 ASIA-PACIFIC MOBILITY AS A SERVICE MARKET: COMPANY SHARE 2020 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。