India Produced Water Treatment Market

Market Size in USD Billion

CAGR :

%

| 2023 –2030 | |

| USD 1,131.71 | |

|

|

|

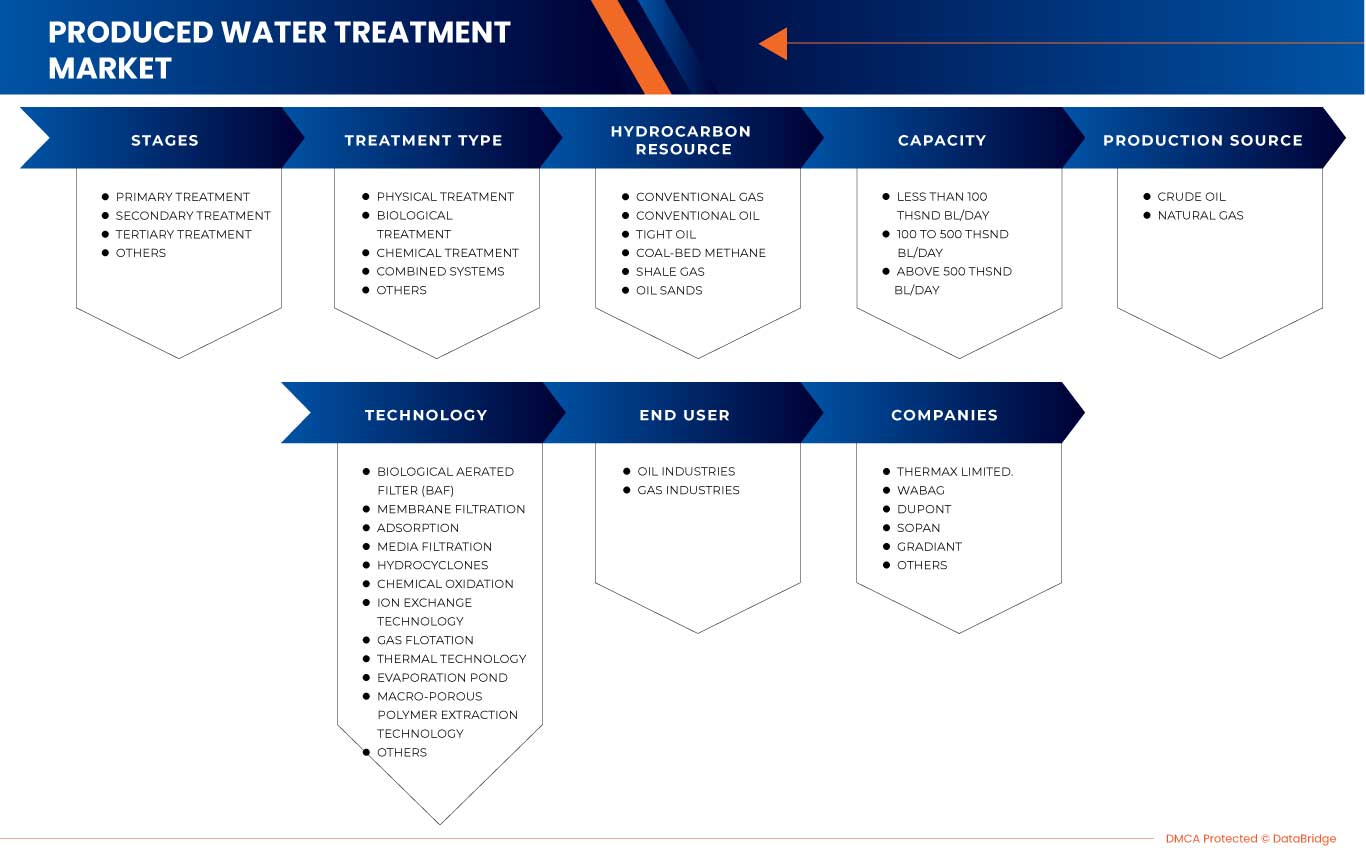

>India Produced Water Treatment Market, By Stages (Primary Treatment, Secondary Treatment, Tertiary Treatment And Others), Treatment Type (Chemical Treatment, Physical Treatment, Biological Treatment, Combined Systems and Others), Hydrocarbon Resource (Conventional Gas, Oil Sands, Conventional Gas, Coal-Bed Methane, Tight Oil, Shale Gas), Capacity (Less Than 100 Thousand Bl/Day, 100 To 500 Thsnd Bl/Day, Above 500 Thsnd Bl/Day), Production Source (Natural Gas, Crude Oil), Technology (Membrane Filtration, Thermal Technology, Biological Aerated Filter (BAF), Hydrocyclones, Gas Flotation, Evaporation Pond, Adsorption, Media Filtration, Ion Exchange Technology, Macro-Porous Extraction Technology, Chemical Oxidation, Others), End User (Oil Industries, Gas Industries) - Industry Trends and Forecast to 2030.

India Produced Water Treatment Market Analysis and Insights

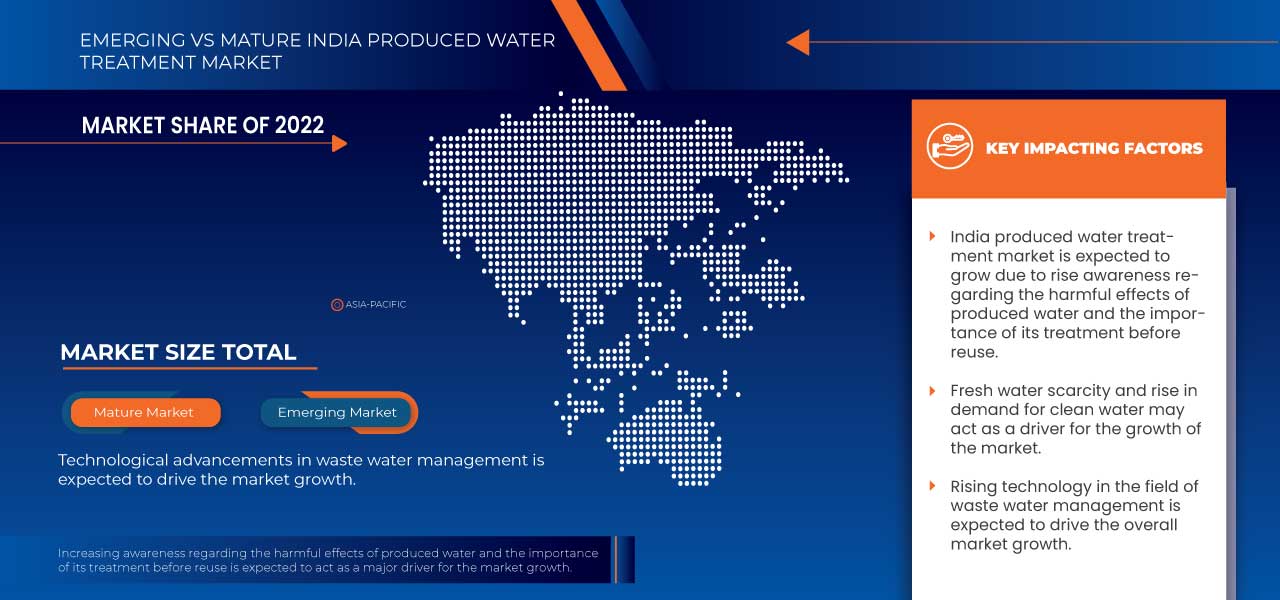

India is one of the world's largest oil and gas producers, and as a result, a significant amount of produced water is generated in the country. The treatment of produced water in India is crucial for maintaining environmental sustainability and public health.

India's produced water treatment process involves several stages, including primary, secondary, and tertiary treatment.

Increasing demand for oil and gas and the growing number of industrial collaborations are some of the drivers boosting India produced water treatment demand in the market.

The major restraint impacting the market is the high cost of plant setup. Also, the strict regulatory framework is a restraining factor for India produced water treatment market. With major companies are expanding their product portfolios in the country to strengthen their presence for these products and solutions in the market.

For instance,

- In 2022, IEI announced that it had been awarded the Water Digest Award 2022 for best research innovation. This award has helped the company in its business line expansion

Data Bridge Market Research analyzes that the India produced water treatment market is expected to reach the value of USD 1,131.71 million by 2030, at a CAGR of 7.2% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Stages (Primary Treatment, Secondary Treatment, Tertiary Treatment And Others), Treatment Type (Chemical Treatment, Physical Treatment, Biological Treatment, Combined Systems and Others), Hydrocarbon Resource (Conventional Gas, Oil Sands, Conventional Gas, Coal-Bed Methane, Tight Oil, Shale Gas), Capacity (Less Than 100 Thousand Bl/Day, 100 To 500 Thsnd Bl/Day, Above 500 Thsnd Bl/Day), Production Source (Natural Gas, Crude Oil), Technology (Membrane Filtration, Thermal Technology, Biological Aerated Filter (BAF), Hydrocyclones, Gas Flotation, Evaporation Pond, Adsorption, Media Filtration, Ion Exchange Technology, Macro-Porous Extraction Technology, Chemical Oxidation, Others), End User (Oil Industries, Gas Industries) |

|

Countries Covered |

India |

|

Market Players Covered |

Thermax Limited. (India), divaenvitec (India), SOPAN (India), www.paramountlimited.com (India), BPC (India), IEI (India), ALFA LAVAL (India), Aquatech International LLC. (U.S.), WABAG (India), IDE (Israel), Wex Technologies (India), NETSOL WATER SOLUTIONS PVT. LTD. (India), OVIVO (India), DuPont (U.S.), Gradiant (U.S.), Hindustan Dorr-Oliver Ltd. (India), NOV Inc. (U.S.), Chokhavatia Associates (India), ULTRA PURE WATER TECHNOLOGIES (India), Veolia (India) among others. |

India Produced Water Treatment Market Definition

Produced water is a term used in the oil and gas industry to refer to the water brought to the surface during oil and gas production. This water often contains contaminants such as oil, grease, dissolved solids, and toxic chemicals, making it unsuitable for direct use or discharge into the environment. Produced water treatment in India refers to the process of treating and cleaning up this water to remove contaminants and make it safe for reuse or discharge. The treatment process typically involves physical, chemical, and biological methods to remove oil and grease, suspended solids, dissolved solids, and other pollutants from the water.

Produced water treatment is essential for protecting the environment and public health and ensuring the sustainability of oil and gas production in India. Several regulations and guidelines are in place to govern produced water treatment in India, including the Oil Industry Safety Directorate (OISD) standards and the Central Pollution Control Board (CPCB) guidelines.

India Produced Water Treatment Market Dynamics

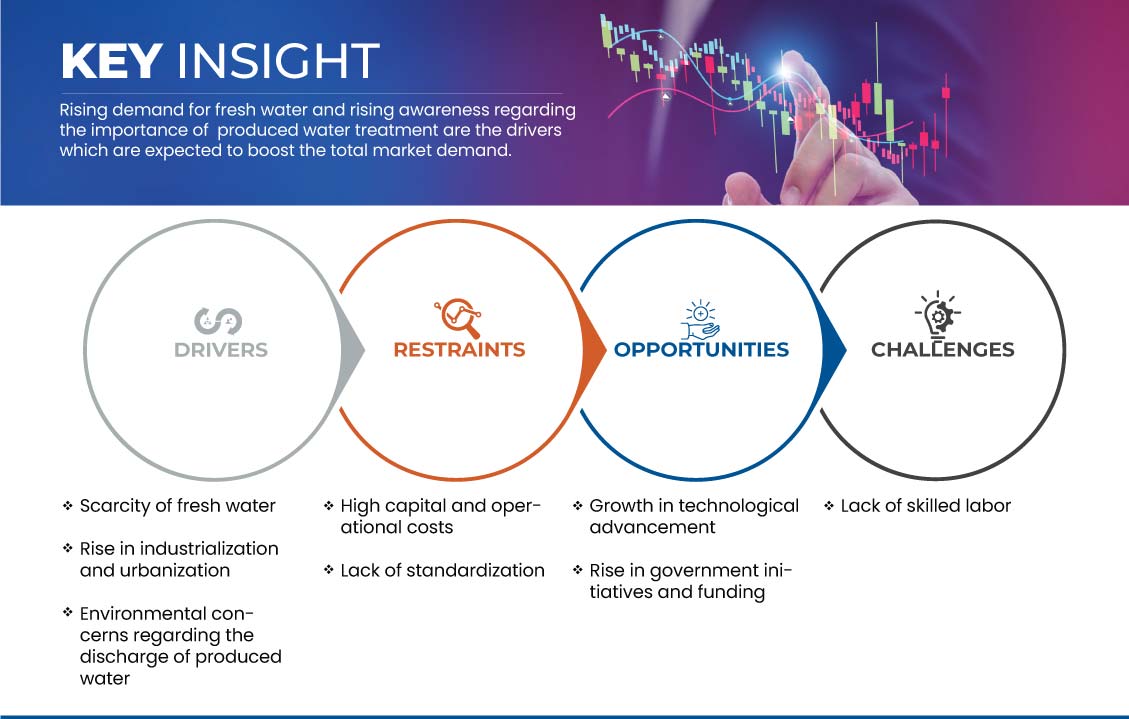

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Driver

- Scarcity of Fresh Water

India is currently experiencing severe freshwater scarcity as a result of a growing population, rapid urbanization, and increased demand for water from agriculture, industry, and households. As a result, there is a growing demand for alternative water sources, such as the treatment and reuse of produced water generated by oil and gas operations.

Produced treated water is not typically considered drinkable because it can still contain trace amounts of contaminants that may be harmful to human health. Produced water is extracted along with oil and gas during production operations, and it can contain a variety of pollutants, such as salts, hydrocarbons, metals, and chemicals. But the treated water can be reused in industries, agriculture, and many other places.

One of the major factors driving the growth of the produced water treatment market in India is the increasing demand for water in various industries. Many industries, including oil and gas, power, and chemical industries, require large quantities of water for their operations. With freshwater resources becoming scarce, these industries are turning to alternative sources of water, such as produced water and treating it for reuse.

Restraint

- High Capital and Operational Costs

While the growth of the produced water treatment market in India is being driven by various factors, such as the rise in industrialization and urbanization, there are also some retrains that are acting as restraining factors, including high capital and operational costs.

Produced water treatment requires specialized equipment and infrastructure, including treatment plants, pipelines, and storage facilities. The high cost of setting up this infrastructure and maintaining it can be a significant barrier to entry for new players in the market, particularly small and medium-sized companies.

In addition to capital costs, operational costs can also be significant, with ongoing expenses, such as energy and maintenance costs. The cost of treating produced water can vary depending on various factors, including the type and amount of contaminants in the water, the technology used, and the location of the treatment facility.

Thus, the high capital and operational costs of produced water treatment is expected to act as a significant restraint for the growth of the produced water treatment market in India.

Opportunity

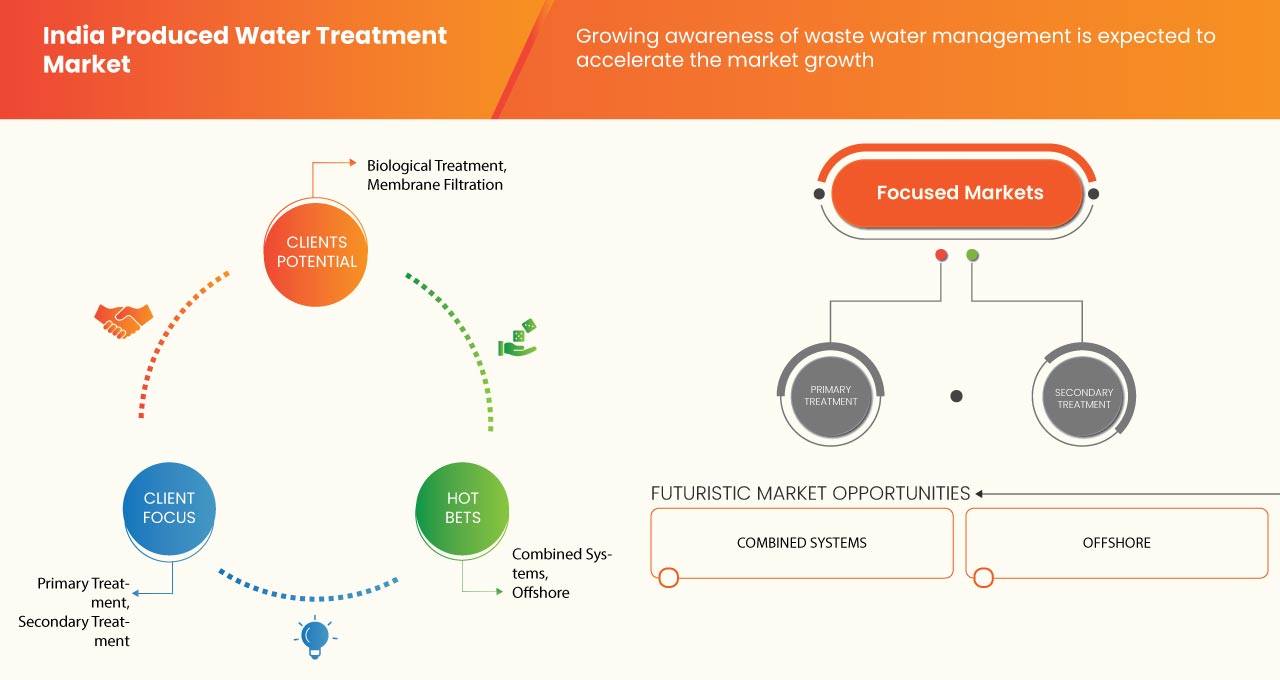

Growth in Technological Advancement

In recent years, India has experienced tremendous growth in technological advancement, particularly in the water treatment industry. With the ever-increasing demand for clean water due to population growth and urbanization, India's water treatment market is expected to continue growing rapidly. This presents a significant opportunity for the growth of the produced water treatment market in India.

Produced water is a byproduct of oil and gas exploration and production. It contains various contaminants, including oil, grease, salts, and heavy metals, making it challenging to treat and dispose of safely. However, with the advancement of technology, produced water treatment has become more efficient and cost-effective, making it a viable solution for the oil and gas industry.

The technology that has been instrumental in the growth of produced water treatment is membrane filtration. Membrane filtration is a process that uses a semi-permeable membrane to separate contaminants from water. It is highly effective in removing oil, grease, and other impurities from produced water, making it safe for discharge or reuse. Membrane filtration technology is also scalable and can be used for various applications, making it a valuable solution for the oil and gas industry.

Challenge

Lack of Skilled Labour

In addition to high capital and operational costs, the lack of skilled labor is limiting the growth of produced water treatment in India. Produced water treatment requires skilled professionals with expertise in a wide range of disciplines, including engineering, chemistry, and environmental science.

Unfortunately, there is a significant shortage of skilled professionals in India's water treatment industry. The shortage can be attributed to a variety of factors, including a lack of quality education and training facilities, a lack of awareness of career opportunities in the water treatment industry, and a brain drain of skilled professionals in developed countries.

The requirement of skilled and certified professionals is a big challenge for produced water treatment.

A lack of skilled professionals can lead to inadequate treatment of produced water, which can harm the environment and human health. It may also cause inefficiencies in the treatment process, resulting in higher operating costs and lower treated water quality.

Furthermore, a scarcity of skilled professionals can hinder the implementation of new technologies and innovations in produced water treatment. Skilled professionals are essential in developing, testing, and implementing new technologies that can improve treatment efficiency and lower costs.

Post COVID-19 Impact Analysis on India Produced Water Treatment Market

Covid-19 has spread across the globe and has impacted various industries. The decrease in the demand and prices of crude oil has affected the oil & gas industry, which has led to a reduction in drilling activities, thus hindering the market's growth. The disruptions in shipping activities, supply chains, and trade due to the spread of COVID-19 have also hampered the growth of the market.

Recent Developments

- In July 2022, OVIVO, a global provider of water and wastewater treatment equipment, technology and systems, announced the acquisition of Wastech Controls & Engineering, LLC.

- In March 2022, ALFA LAVAL acquired a minority stake in the Netherlands-based company Marine Performance Systems (MPS). This acquisition has helped the company in business and product expansion.

India Produced Water Treatment Market Scope

India produced water treatment market is categorized into seven notable segments such as stages, treatment type, hydrocarbon resource, capacity, production source, technology, and end user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

STAGES

- Primary Treatment

- Secondary Treatment

- Tertiary Treatment

- Others

On the basis of stages, India produced water treatment market is segmented into primary treatment, secondary treatment, tertiary treatment and others.

TREATMENT TYPE

- Chemical Treatment

- Physical Treatment

- Biological Treatment

- Combined Systems

- Others

On the basis of treatment type, India produced water treatment market is segmented into chemical treatment, physical treatment, biological Treatment, combined systems and others.

HYDROCARBON RESOURCE

- Conventional Oil

- Oil Sands

- Conventional Gas

- Coal-Bed Methane

- Tight Oil

- Shale Gas

On the basis of hydrocarbon resources, India produced water treatment market is segmented into conventional oil, oil sands, conventional gas, coal-bed methane, tight oil, and shale gas.

CAPACITY

- Less than 100 Thsnd BL/DAY

- 100 to 500 Thsnd BL/DAY

- Above 500 Thsnd BL/DAY

On the basis of capacity, India produced water treatment market is segmented into less than 100 thsnd bl/day, 100 to 500 thsnd bl/day, and above 500 thsnd bl/day.

PRODUCTION SOURCE

- Natural Gas

- Crude Oil

On the basis of production source, India produced water treatment market is segmented into natural gas and crude oil.

TECHNOLOGY

- Membrane Filtration

- Thermal Technology

- Biological Aerated Filter (BAF)

- Hydrocyclones

- Gas Flotation

- Evaporation Pond

- Adsorption

- Media Filtration

- Ion Exchange Technology

- Macro-Porous Polymer Extraction Technology

- Chemical Oxidation

- Others

On the basis of technology, India produced water treatment market is segmented into membrane filtration, thermal technology, biological aerated filter (BAF), hydrocyclones, gas flotation, evaporation pond, adsorption, media filtration, ion exchange technology, macro-porous polymer extraction technology, chemical oxidation, others.

END USER

- Oil Industries

- Gas Industries

On the basis of end user, India produced water treatment market is segmented into oil industries gas industries.

India Produced Water Treatment Market Regional Analysis/Insights

India produced water treatment market is categorized into seven notable segments such as stages, treatment type, hydrocarbon resource, capacity, production source, technology, and end user.

The country covered in this market report is India.

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響も考慮されます。

競争環境とインドの水処理市場シェア分析

インドの水処理市場の競争状況は、競合他社ごとに詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品の承認、製品の幅と幅、アプリケーションの優位性、および製品タイプのライフライン曲線が含まれます。上記のデータ ポイントは、インドの水処理市場への会社の重点にのみ関連しています。

インドの産出水処理市場を扱っている大手企業には、Thermax Limited(インド)、divaenvitec(インド)、SOPAN(インド)、www.paramountlimited.com(インド)、BPC(インド)、IEI(インド)、ALFA LAVAL(インド)、Aquatech International LLC(米国)、WABAG(インド)、IDE(イスラエル)、Wex Technologies(インド)、NETSOL WATER SOLUTIONS PVT. LTD.(インド)、OVIVO(インド)、DuPont(米国)、Gradiant(米国)、Hindustan Dorr-Oliver Ltd.(インド)、NOV Inc.(米国)、Chokhavatia Associates(インド)、ULTRA PURE WATER TECHNOLOGIES(インド)、Veolia(インド)などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA PRODUCED WATER TREATMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 STAGES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

5 INDIA PRODUCED WATER TREATMENT MARKET, REGULATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 SCARCITY OF FRESH WATER

6.1.2 RISE IN INDUSTRIALIZATION AND URBANIZATION

6.1.3 ENVIRONMENTAL CONCERNS REGARDING THE DISCHARGE OF PRODUCED WATER

6.2 RESTRAINS

6.2.1 HIGH CAPITAL AND OPERATIONAL COSTS

6.2.2 LACK OF STANDARDIZATION

6.3 OPPORTUNITIES

6.3.1 GROWTH IN TECHNOLOGICAL ADVANCEMENT

6.3.2 RISE IN GOVERNMENT INITIATIVES AND FUNDING

6.4 CHALLENGES

6.4.1 LACK OF SKILLED LABOUR

7 INDIA PRODUCED WATER TREATMENT MARKET, BY STAGES

7.1 OVERVIEW

7.2 PRIMARY TREATMENT

7.3 SECONDARY TREATMENT

7.4 TERTIARY TREATMENT

7.5 OTHERS

8 INDIA PRODUCED WATER TREATMENT MARKET, BY TREATMENT TYPE

8.1 OVERVIEW

8.2 PHYSICAL TREATMENT

8.3 BIOLOGICAL TREATMENT

8.4 CHEMICAL TREATMENT

8.5 COMBINED SYSTEMS

8.6 OTHERS

9 INDIA PRODUCED WATER TREATMENT MARKET, BY HYDROCARBON RESOURCE

9.1 OVERVIEW

9.2 CONVENTIONAL GAS

9.3 CONVENTIONAL OIL

9.4 TIGHT OIL

9.5 COAL-BED METHANE

9.6 SHALE GAS

9.7 OIL SANDS

10 INDIA PRODUCED WATER TREATMENT MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 LESS THAN 100 THSND BL/DAY

10.3 100 TO 500 THSND BL/DAY

10.4 ABOVE 500 THSND BL/DAY

11 INDIA PRODUCED WATER TREATMENT MARKET, BY PRODUCTION SOURCE

11.1 OVERVIEW

11.2 CRUDE OIL

11.3 NATURAL GAS

12 INDIA PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY

12.1 OVERVIEW

12.2 BIOLOGICAL AERATED FILTER (BAF)

12.3 MEMBRANE FILTRATION

12.3.1 MICROFILTRATION/ULTRAFILTRATION

12.3.2 REVERSE OSMOSIS AND NANOFILTRATION

12.3.3 POLYMERIC/CERAMIC MEMBRANES

12.4 ADSORPTION

12.5 MEDIA FILTRATION

12.6 HYDROCYCLONES

12.7 CHEMICAL OXIDATION

12.8 ION EXCHANGE TECHNOLOGY

12.9 GAS FLOTATION

12.1 THERMAL TECHNOLOGY

12.10.1 MULTISTAGE FLASH

12.10.2 MULTIEFFECT DISTILLATION

12.10.3 VAPOR COMPRESSION DISTILLATION

12.10.4 MULTIEFFECT DISTILLATION– VAPOR COMPRESSION HYBRID

12.11 EVAPORATION POND

12.12 MACRO-POROUS POLYMER EXTRACTION TECHNOLOGY

12.13 OTHERS

13 INDIA PRODUCED WATER TREATMENT MARKET, BY END USER

13.1 OVERVIEW

13.2 OIL INDUSTRIES

13.2.1 BY TYPE

13.2.1.1 ONSHORE

13.2.1.2 OFFSHORE

13.2.2 BY TECHNOLOGY

13.2.2.1 BIOLOGICAL AERATED FILTER (BAF)

13.2.2.2 MEMBRANE FILTRATION

13.2.2.3 ADSORPTION

13.2.2.4 MEDIA FILTRATION

13.2.2.5 HYDROCYCLONES

13.2.2.6 CHEMICAL OXIDATION

13.2.2.7 ION EXCHANGE TECHNOLOGY

13.2.2.8 GAS FLOTATION

13.2.2.9 THERMAL TECHNOLOGY

13.2.2.10 EVAPORATION POND

13.2.2.11 MACRO-POROUS POLYMER EXTRACTION TECHNOLOGY

13.2.2.12 OTHERS

13.3 GAS INDUSTRIES

13.3.1 BY TYPE

13.3.1.1 ONSHORE

13.3.1.2 OFFSHORE

13.3.2 BY TECHNOLOGY

13.3.2.1 BIOLOGICAL AERATED FILTER (BAF)

13.3.2.2 MEMBRANE FILTRATION

13.3.2.3 ADSORPTION

13.3.2.4 MEDIA FILTRATION

13.3.2.5 HYDROCYCLONES

13.3.2.6 CHEMICAL OXIDATION

13.3.2.7 ION EXCHANGE TECHNOLOGY

13.3.2.8 GAS FLOTATION

13.3.2.9 THERMAL TECHNOLOGY

13.3.2.10 EVAPORATION POND

13.3.2.11 MACRO-POROUS POLYMER EXTRACTION TECHNOLOGY

13.3.2.12 OTHERS

14 INDIA PRODUCED WATER TREATMENT MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: INDIA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 THERMAX LIMITED

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 WABAG

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 DUPONT

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 SOPAN

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENTS

16.5 GRADIANT

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 ALFA LAVAL

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AQUATECH INTERNATIONAL LLC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 BPC

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 CHOKHAVATIA ASSOCIATES

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DIVAENVITEC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 HINDUSTAN DORR-OLIVER LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 IEI

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 IDE

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 NETSOL WATER SOLUTIONS PVT. LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 NOV INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 OVIVO

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 ULTRA PURE WATER TECHNOLOGIES

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 VEOLIA

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 WEX TECHNOLOGIES

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 WWW.WWW.PARAMOUNTLIMITED.COM.COM

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

表のリスト

TABLE 1 INDIA PRODUCED WATER TREATMENT MARKET, BY STAGES, 2021-2030 (USD MILLION)

TABLE 2 INDIA PRODUCED WATER TREATMENT MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 3 INDIA PRODUCED WATER TREATMENT MARKET, BY HYDROCARBON RESOURCE, 2021-2030 (USD MILLION)

TABLE 4 INDIA PRODUCED WATER TREATMENT MARKET, BY CAPACITY, 2021-2030 (USD MILLION)

TABLE 5 INDIA PRODUCED WATER TREATMENT MARKET, BY PRODUCTION SOURCE, 2021-2030 (USD MILLION)

TABLE 6 INDIA PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 7 INDIA MEMBRANE FILTRATION IN PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 8 INDIA THERMAL TECHNOLOGY IN PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 9 INDIA PRODUCED WATER TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 10 INDIA OIL INDUSTRIES IN PRODUCED WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 INDIA OIL INDUSTRIES IN PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 12 INDIA GAS INDUSTRIES IN PRODUCED WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 INDIA GAS INDUSTRIES IN PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 INDIA PRODUCED WATER TREATMENT MARKET: SEGMENTATION

FIGURE 2 INDIA PRODUCED WATER TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 INDIA PRODUCED WATER TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 INDIA PRODUCED WATER TREATMENT MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 INDIA PRODUCED WATER TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA PRODUCED WATER TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA PRODUCED WATER TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA PRODUCED WATER TREATMENT MARKET: END USER COVERAGE GRID

FIGURE 9 INDIA PRODUCED WATER TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 INDIA PRODUCED WATER TREATMENT MARKET: SEGMENTATION

FIGURE 11 TECHNOLOGICAL ADVANCEMENT IS EXPECTED TO DRIVE THE INDIA PRODUCED WATER TREATMENT MARKET IN THE FORECAST PERIOD 2023-2030

FIGURE 12 PRIMARY TREATMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA PRODUCED WATER TREATMENT MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES OF INDIA PRODUCED WATER TREATMENT MARKET

FIGURE 14 INDIA PRODUCED WATER TREATMENT MARKET: BY STAGES, 2022

FIGURE 15 INDIA PRODUCED WATER TREATMENT MARKET: BY STAGES, 2023-2030 (USD MILLION)

FIGURE 16 INDIA PRODUCED WATER TREATMENT MARKET: BY STAGES, CAGR (2023-2030)

FIGURE 17 INDIA PRODUCED WATER TREATMENT MARKET: BY STAGES, LIFELINE CURVE

FIGURE 18 INDIA PRODUCED WATER TREATMENT MARKET: BY TREATMENT TYPE, 2022

FIGURE 19 INDIA PRODUCED WATER TREATMENT MARKET: BY TREATMENT TYPE, 2023-2030 (USD MILLION)

FIGURE 20 INDIA PRODUCED WATER TREATMENT MARKET: BY TREATMENT TYPE, CAGR (2023-2030)

FIGURE 21 INDIA PRODUCED WATER TREATMENT MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 22 INDIA PRODUCED WATER TREATMENT MARKET: BY HYDROCARBON RESOURCE, 2022

FIGURE 23 INDIA PRODUCED WATER TREATMENT MARKET: BY HYDROCARBON RESOURCE, 2023-2030 (USD MILLION)

FIGURE 24 INDIA PRODUCED WATER TREATMENT MARKET: BY HYDROCARBON RESOURCE, CAGR (2023-2030)

FIGURE 25 INDIA PRODUCED WATER TREATMENT MARKET: BY HYDROCARBON RESOURCE, LIFELINE CURVE

FIGURE 26 INDIA PRODUCED WATER TREATMENT MARKET: BY CAPACITY, 2022

FIGURE 27 INDIA PRODUCED WATER TREATMENT MARKET: BY CAPACITY, 2023-2030 (USD MILLION)

FIGURE 28 INDIA PRODUCED WATER TREATMENT MARKET: BY CAPACITY, CAGR (2023-2030)

FIGURE 29 INDIA PRODUCED WATER TREATMENT MARKET: BY CAPACITY, LIFELINE CURVE

FIGURE 30 INDIA PRODUCED WATER TREATMENT MARKET: BY PRODUCTION SOURCE, 2022

FIGURE 31 INDIA PRODUCED WATER TREATMENT MARKET: BY PRODUCTION SOURCE, 2023-2030 (USD MILLION)

FIGURE 32 INDIA PRODUCED WATER TREATMENT MARKET: BY PRODUCTION SOURCE, CAGR (2023-2030)

FIGURE 33 INDIA PRODUCED WATER TREATMENT MARKET: BY PRODUCTION SOURCE, LIFELINE CURVE

FIGURE 34 INDIA PRODUCED WATER TREATMENT MARKET: BY TECHNOLOGY, 2022

FIGURE 35 INDIA PRODUCED WATER TREATMENT MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 36 INDIA PRODUCED WATER TREATMENT MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 37 INDIA PRODUCED WATER TREATMENT MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 38 INDIA PRODUCED WATER TREATMENT MARKET: BY END USER, 2022

FIGURE 39 INDIA PRODUCED WATER TREATMENT MARKET: BY END USER 2023-2030 (USD MILLION)

FIGURE 40 INDIA PRODUCED WATER TREATMENT MARKET: BY END USER, CAGR (2023-2030)

FIGURE 41 INDIA PRODUCED WATER TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 42 INDIA PRODUCED WATER TREATMENT MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。