A blood glucose test strip is a crucial component in the field of medical diagnostics, specifically designed for monitoring and managing diabetes. These small, disposable strips are equipped with specialized chemicals that react with glucose present in a blood sample. Typically used in conjunction with a glucose meter these strips enable individuals with diabetes to measure their blood sugar levels accurately and conveniently at home or in clinical settings.

Access full Report @ https://www.databridgemarketresearch.com/de/reports/saudi-arabia-blood-glucose-test-strip-market

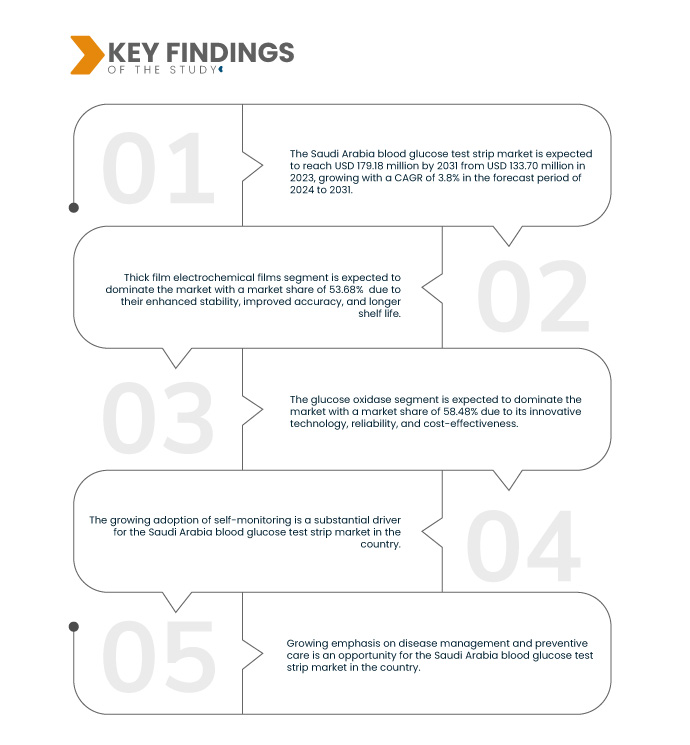

Data Bridge Market Research analyses that the Saudi Arabia Blood Glucose Test Strip Market is growing with a CAGR of 3.8% in the forecast period of 2024 to 2031 and is expected reach USD 179.18 million by 2031 from USD 133.70 million in 2023.

Key Findings of the Study

Rising Prevalence of Diabetes

The increasing prevalence of risk factors such as inactive lifestyles, unhealthy dietary habits, obesity, and aging populations contributes to the growing number of individuals diagnosed with diabetes. With more people living with diabetes, there is a larger market for diabetes management products, including blood glucose test strips. For individuals with diabetes, regular monitoring of blood glucose levels is essential for managing the condition and preventing complications. Blood glucose test strips allow patients to monitor their blood sugar levels at home or on the go, providing valuable information to guide dietary choices, medication dosing, and lifestyle modifications. As diabetes becomes more prevalent, the importance of effective glucose monitoring becomes increasingly recognized, driving the demand for test strips.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Type (Thick Film Electrochemical Films, Thin Film Electrochemical Films, and Optical Strips), Technology (Glucose Oxidase and Glucose Dehydrogenase), Modality (Use and Throw and Built-In Indicator), Pricing (Standard and Premium), Sample (Whole Blood and Plasma), Mode of Purchase (Over the Counter and Prescription Based), Packaging (50 Strips, 100 Strips, and 25 Strips), Age Group (Adult, Geriatric, and Pediatric), Application (Type 2 Diabetes, Type 1 Diabetes, Pre-Diabetes, And Gestational Diabetes), End User (Home Healthcare, Hospital, Diagnostic Laboratory, and Others), Distribution Channel (Retail Sales, Direct Tender, and Others)

|

|

Countries Covered

|

Saudi Arabia

|

|

Market Players Covered

|

Abbott (U.S.), F. Hoffmann-La Roche Ltd. (Switzerland), Ascensia Diabetes Care Holdings AG. (Switzerland), LifeScan IP Holdings (U.S), LLC. EASYMAX Diabetes Care (Taiwan), Sinocare (China), Bionime Corporation. (Taiwan), ARKRAY, Inc. (Japan), Trister (U.S.), and General Life Biotechnology Co., Ltd. (China) among others

|

|

Report Metric

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework

|

Segment Analysis

The Saudi Arabia blood glucose test strip market is categorized into eleven notable segments based on type, technology, modality, pricing, sample, mode of purchasing, packaging, age group, application, end user, and distribution channel.

- On the basis of type, the market is segmented into thick film electrochemical films, thin film electrochemical films, and optical strips

In 2024, thick film electrochemical films segment is expected to dominate the market

In 2024, thick film electrochemical films segment is expected to dominate the market with a market share of 53.68% due to their enhanced stability, improved accuracy, and longer shelf life.

- On the basis of technology, the market is segmented into glucose oxidase and glucose dehydrogenase

In 2024, the glucose oxidase segment is expected to dominate the market

In 2024, the glucose oxidase segment is expected to dominate the market with a market share of 58.48% due to its innovative technology, reliability, and cost-effectiveness.

- On the basis of modality, the market is segmented into use and throw and built-in indicator

In 2024, the use and throw segment is expected to dominate the market

In 2024, the use and throw segment is expected to dominate the market with a market share of 89.24% due to its convenience, hygiene, and elimination of the need for cleaning and maintenance, offering a user-friendly and efficient solution for regular monitoring in diabetes management.

- On the basis of pricing, the market is segmented into standard and premium

In 2024, the standard segment is expected to dominate the market

In 2024, the standard segment is expected to dominate the market with a market share of 84.94% due to affordability and accessibility, making it a preferred choice for a larger consumer base.

- On the basis of sample, the market is segmented into whole blood and plasma

In 2024, the whole blood segment is expected to dominate the market

In 2024, the whole blood segment is expected to dominate the market with a market share of 85.93% due to convenient real-time glucose level measurements for individuals with diabetes.

- On the basis of mode of purchase, the market is segmented into over the counter and prescription based

In 2024, the over the counter segment is expected to dominate the market

In 2024, the over the counter segment is expected to dominate the market with a market share of 79.63% due to accessibility, allowing individuals with diabetes to easily obtain and monitor their blood sugar levels without the need for a prescription.

- On the basis of packaging, the market is segmented into 50 strips, 100 strips, and 25 strips

In 2024, the 50 strips segment is expected to dominate the market

In 2024, the 50 strips segment is expected to dominate the market with a market share of 70.43% due to cost-effectiveness and the convenience of providing an extended supply for continuous blood glucose monitoring, promoting adherence to regular testing.

- On the basis of age group, the market is segmented into adult, geriatric, and pediatric

In 2024, the adult segment is expected to dominate the market

In 2024, the adult segment is expected to dominate the market with a market share of 68.05% due to the higher prevalence of diabetes in the adult population compared to other age groups.

- On the basis of application, the market is segmented into type 2 diabetes, type 1 diabetes, pre-diabetes, and gestational diabetes

In 2024, the type 2 diabetes segment is expected to dominate the market

In 2024, the type 2 diabetes segment is expected to dominate the market with a market share of 48.94% due to higher prevalence of this form of diabetes globally.

- On the basis of end user, the market is segmented into home healthcare, hospital, diagnostic laboratory, and others

In 2024, the home health care segment is expected to dominate the market

In 2024, the home health care segment is expected to dominate the market with a market share of 45.58% due to the availability of advanced kits in hospitals and the rise in disposable income.

- On the basis of distribution channel, the market is segmented into retail sales, direct tender, and others

In 2024, the retail sales segment is expected to dominate the market

In 2024, the retail sales segment is expected to dominate the market with a market share of 75.97% due to the rise in contractual agreements between manufacturers and distributors in the tendering process.

Major Players

Data Bridge Market Research analyzes F. Hoffmann-La Roche Ltd. (Switzerland), LifeScan IP Holdings LLC. (U.S.), Abbott (U.S.), Ascensia Diabetes Care Holdings AG. (Switzerland), and Sinocare (China) as the major player of the Saudi Arabia blood glucose test strip market.

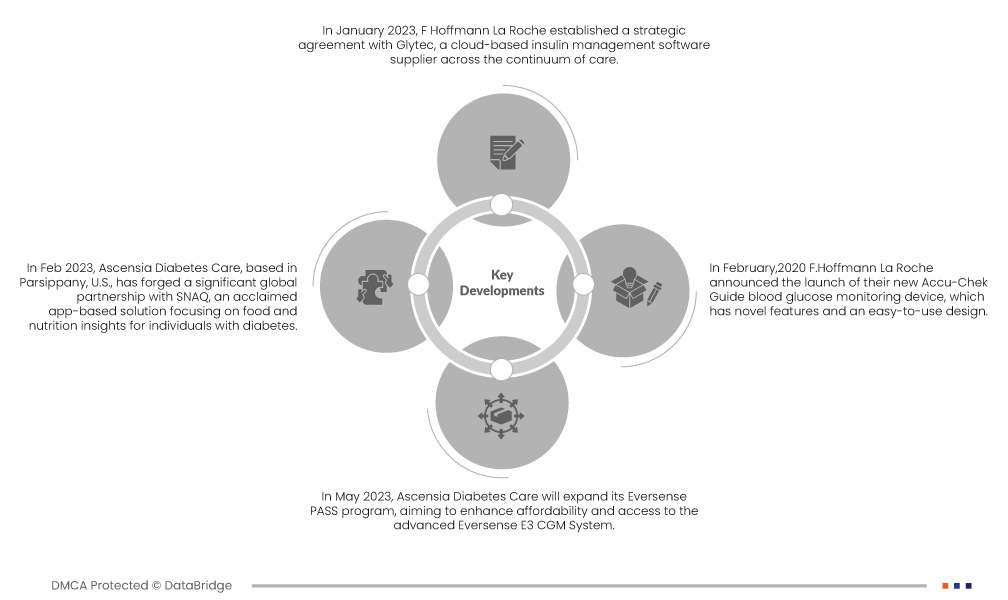

Market Developments

- In October 2023, as per Drug Delivery Business News, Abbott is one of the market leaders in the diabetes space with its continuous glucose monitoring (CGM) technology. It continues updating its FreeStyle Libre 2 CGM, while it began rolling out the FreeStyle Libre 3 after receiving FDA clearance last year. This may help the company to establish its strong presence in diabetes management and care

- In May 2023, Ascensia Diabetes Care will expand its Eversense PASS program, aiming to enhance affordability and access to the advanced Eversense E3 CGM System. The initiative, featuring increased savings for eligible first-time users, reflects Ascensia's commitment to widening access and alleviating financial barriers for individuals in need of advanced glucose monitoring solutions

- In January 2023, F Hoffmann La Roche established a strategic agreement with Glytec, a cloud-based insulin management software supplier across the continuum of care. To address the issues of inpatient blood sugar management at the hospital bedside, this digital health collaboration incorporates Roche's expertise in medical devices and IT solutions with Glytec's FDA-cleared insulin dosing decision support software, Glucommander. Glucommander will be the first software program available for Roche's Cobas pulse smart-device next-generation hospital blood glucose system, which is aimed to improve patient safety and care by allowing point-of-care doctors to collect and act on glycaemic management data in real-time

For more detailed information about Saudi Arabia Blood Glucose Test Strip Market Report, click here – https://www.databridgemarketresearch.com/de/reports/saudi-arabia-blood-glucose-test-strip-market